AI Will Do the Math. Advisors Must Do the Human Work.

This article is based on insights from a recent episode of Visionary Advisor, where Alex Kirby, founder of Total Family, speaks with Jennifer Musil and Melissa Schweizer of The Harris Poll. Together, they unpack findings from America’s Great Wealth Transfer and a custom legacy study exploring how families define legacy today.

→ Explore the Harris Poll research

Legacy is no longer defined by dollars alone

For much of modern wealth management, legacy has been treated as a financial problem: how much wealth is transferred, how efficiently it moves, and how long it lasts across generations.

As the Great Wealth Transfer accelerates, that definition is changing. Families increasingly measure legacy not only by financial outcomes, but by whether the next generation is thriving, healthy, and grounded in shared values.

This shift creates a quiet but consequential tension for advisors. Financial excellence still matters, but it is no longer sufficient on its own.

The rising generation is not rejecting money or expertise. They are placing it in context. Financial capital becomes one part of a broader story that includes well-being, relationships, identity, and trust. These dimensions shape how heirs interpret wealth long before they decide who should help manage it.

The Great Wealth Transfer is not just moving assets. It is exposing a mismatch between how true wealth has been defined and managed, and how legacy is now understood.

When families see the full picture, financial capital is not always first

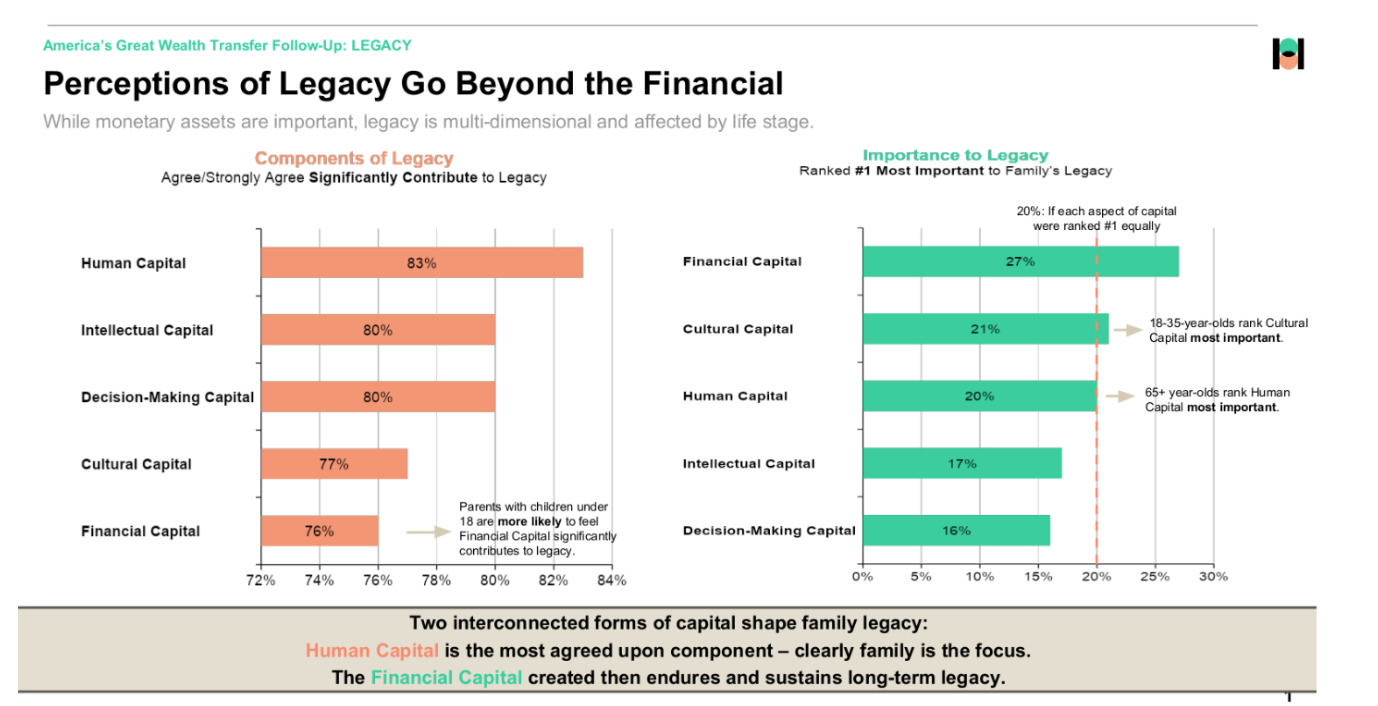

To understand how families define legacy, The Harris Poll evaluated perceptions through five forms of family capital: human, intellectual, decision-making, cultural, and financial.

When respondents considered all five together, agreement was strong across every category. But human capital, defined as the well-being and development of each family member, ranked highest, while financial capital ranked lowest overall.

This image represents data from a custom study conducted by The Harris Poll in Q4 2025.

When forced to choose just one category, financial capital moved to the top at 27%. Even then, nearly three quarters of respondents selected something other than money. Younger respondents were more likely to prioritize cultural capital, while older respondents leaned toward human capital.

For advisors, the message is clear. Money still matters, but when families think holistically about legacy, they consistently elevate dimensions that require conversation, judgment, and trust, not just financial execution.

Why the intangibles consistently edge out money

Legacy becomes easier to understand when it is framed as more than a transfer of assets. Money is tangible and easy to measure, but when families consider what they are truly leaving behind, the conversation expands from what heirs receive to who they become.

In the latest Visionary Advisor episode, Melissa Schweizer and Jennifer Musil of The Harris Poll noted that when respondents were shown all five forms of family capital together, financial capital still mattered, but no longer stood alone at the top. What rose in its place were questions families care deeply about but rarely quantify. Are the next generation happy, healthy, and contributing meaningfully to society?

This perspective reframes the advisor’s role. Financial expertise remains essential, but it now operates within a broader human context. Advisors are not only preserving wealth. They are helping families align wealth with values, relationships, and long-term well-being. When those conversations are missing, wealth may transfer efficiently, but the meaning, stories, and lessons that give it life are often lost.

AI will handle the mechanics, but legacy decisions are not mechanical

Artificial intelligence is rapidly raising the baseline for financial execution. Explanations, projections, and scenario modeling are becoming faster and more accessible, and for many clients, especially younger ones, AI will be the first stop for answers.

That shift does not diminish the advisor’s role. It clarifies it.

AI excels at mechanics. Legacy decisions are not mechanical. Inheritance carries emotional complexity technology cannot fully interpret. Family history, grief, guilt, identity, and values shape how decisions are made and experienced, and rarely fit cleanly into prompts or models.

In the latest Visionary Advisor episode, Jennifer Musil captured this boundary clearly. Digital tools can explain financial concepts, but they cannot carry the emotional and cultural weight behind family decisions.

As AI takes care of foundational tasks, the advisor’s value moves upstream. The differentiator becomes the ability to listen, contextualize, and guide families through decisions technology can support, but not lead.

The real advisor advantage is trust built before money moves

As financial tools become more powerful, the advisor’s edge becomes more human. Families are not only transferring assets. They are navigating identity, values, and responsibility across generations.

Advisors who earn trust early, listen well, and engage heirs before money changes hands will remain indispensable. In the Great Wealth Transfer, relevance will not be decided by technology alone, but by who families trust to guide them through what matters most.

Looking for more Legacy content?

Explore clips from this Visionary Advisor episode and discover more articles focused on legacy, values, and the human side of the Great Wealth Transfer.

→ Explore episode clips

→ Read more articles