Talking to Pre-Adult Children About Money and Wealth (For Families)

A Total Family Best Practices Guide

At some point, nearly every parent wonders when — and how — to talk to their kids about money. It’s a foundational part of raising financially responsible children, and more families today are asking how to do it in a way that aligns with their values.

We define “pre-adult” broadly. For some families, that means a curious 10-year-old asking about lifestyle. For others, it’s a 22-year-old beginning to launch. Kids are staying connected longer, launching later, and forming views about money, success, and values throughout that entire journey.

The key isn’t about getting the timing perfect — it’s about staying intentional. This guide shares a few best practices we’ve seen work across many families navigating intergenerational wealth transfer, financial literacy for children, and values-based planning.

1. Involve your advisor early

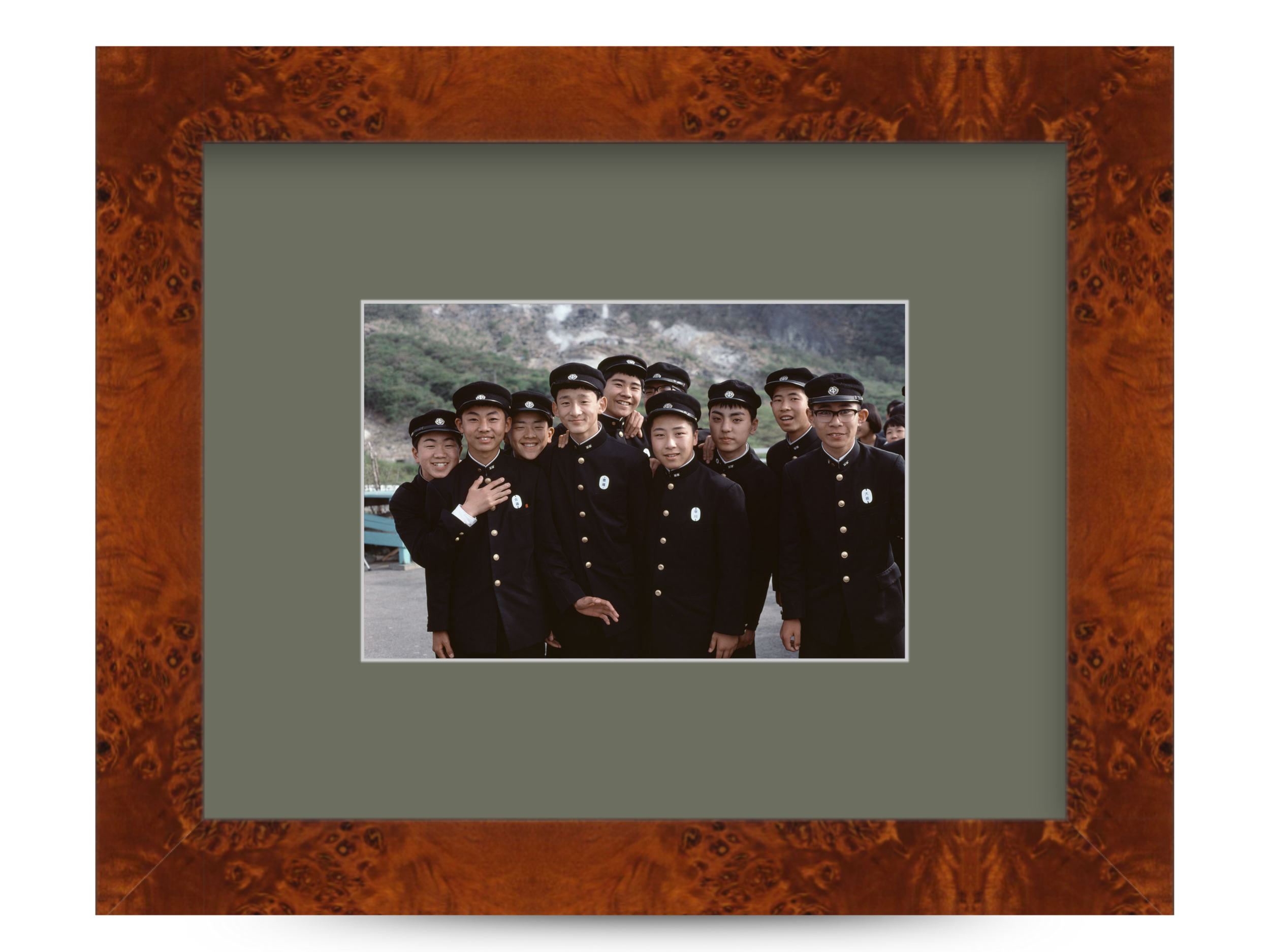

One of the most effective things parents can do is involve their advisor or planning team early in the conversation. This doesn’t need to be formal. It might start with a conversation about your goals or concerns as a parent. Some families go a step further and invite their pre-adult children to quietly sit in on selected advisor meetings — not to share private financial details, but simply to observe.

Think of it like onboarding a future team member. At first, they’re just in the room. Silent observation builds comfort, normalizes financial dialogue, and lays the groundwork for deeper engagement over time. These small exposures help prepare next-gen heirs for future roles and decision-making, without overwhelming them.

2. Balance transparency with timing

Extreme secrecy and full disclosure both carry risks. Sharing every detail about the family’s wealth too early can lead to anxiety or unrealistic expectations. But waiting too long — or avoiding the conversation entirely — leaves room for confusion, assumptions, or misinformation.

As Jay Hughes often reminds families: most say too little, too late.

When your child starts asking questions, that’s often the best signal that it’s time to start answering. Many parents grew up hearing that it’s rude to talk about money. But when a child asks, they’re often not being entitled — they’re being curious. That curiosity is worth engaging. It’s also a sign they’re ready for some level of family financial literacy.

A helpful way to frame wealth for young people is with this simple model:

– Some people don’t have enough

– Some people have enough

– Some people have more than enough

You might say, “We’re fortunate to be in the group that has more than enough — and with that comes responsibility.” That can lead naturally into conversations about values, purpose, and decision-making — all part of teaching kids about money values in a healthy, grounded way.

3. Introduce the idea of wealth beyond money

Wealth isn’t just financial — it’s emotional, cultural, relational, and generational. And the earlier you can begin shaping how your family defines wealth, the stronger your foundation becomes.

Through FamilyOS and in collaboration with advisors across the country, we help families explore their shared values, define their vision, and reflect on meaningful life experiences. These conversations don’t have to be formal. They can start with a single story, a lesson you want to pass on, or a moment that shaped your family’s perspective.

One analogy that resonates with many families comes from David York:

You’ve worked hard to build a fire that keeps your family warm. But when your children go out into the world, they can’t carry your fire with them. They’ll need to make their own.

Your role isn’t to pass on the flame — it’s to pass on the tools.

4. When should you start talking to kids about money?

There’s no perfect age. But the moment your child starts asking about money, lifestyle, or fairness, they may be ready for a first conversation. Don’t ignore it. It doesn’t need to be a full disclosure of your balance sheet — just a window into your values and what matters to your family.

Even a small, honest response can start building their financial awareness and help them feel included — which is especially important in wealth education for teens and young adults.

5. What if your child already has strong views about wealth or privilege?

That’s all the more reason to engage. Teenagers and young adults are forming beliefs from friends, online culture, and the news. Your lived experience, family story, and perspective offer something deeper and more personal than anything they’ll find on social media.

Talking to children about privilege isn’t always comfortable — but it’s a powerful way to shape their character and worldview.

6. What if you and your spouse or partner don’t agree?

You’re not alone. This happens in many families. One partner might feel more private, while the other wants to be fully transparent. Often, the difference isn’t really about the money — it’s about what each of you hopes for your child.

A helpful first step is to zoom out. Talk about your shared values, your purpose as parents, and the kind of relationship you hope to build with your children over time. That shared vision can be clarifying.

Many parents say they want their children to grow up hardworking, kind, responsible, and grounded. Having financial resources doesn’t make that impossible — it just requires more intentionality. In fact, it creates space to be more thoughtful about what you want to pass on.

These conversations don’t have to be contentious. They can be some of the most meaningful conversations you have as a couple — and a valuable foundation for your family’s long-term success.

Start with one conversation. Then build from there.

Every family is different. But the families who start early — and approach the topic of wealth with care and openness — tend to have fewer regrets later on.

Let your advisor help guide the next step. Whether it's aligning as a couple, bringing your child into the room for the first time, or beginning to name what matters most, small steps can make a lasting difference in how your family stewards its wealth across generations.